Acquisition Criteria

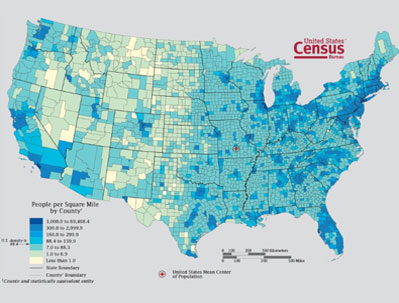

AmCap acquires Core, Core-Plus and Value-Add grocery-anchored and necessity-focused shopping centers nationwide with values between $15 million and $200 million. Our record for efficient closing is exceptional.

Single properties or multi-property portfolios will be considered, in asset or loan format.

OUR CRITERIA

AmCap actively pursues neighborhood, community, power, and lifestyle centers with the following preferred characteristics.

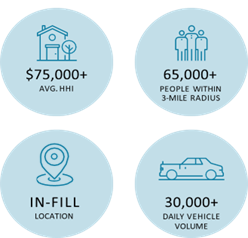

- Affluent Neighborhoods - $65K+ Average Household Income within 3 miles

- Dense Populations – 65K+ within 3 miles

- Heavy Traffic – 30K+ daily vehicle volume

- Well Located – Benefits from two-way traffic flows

- Strong Access – Parallel to main road with convenient accessibility

- Great Visibility – Clear site line to tenants from road

- Strong Performance – Positive operating history, strong tenant sales, minimum occupancy ~75%

- ‘Infill’ Location – High barriers to entry

- Leading Grocery Anchor – Must be a top grocer in the region

Portfolio Highlight: Short Pump Station - Glen Allen, VA

- Site plan with tenant roster

- Rent rolls with lease details

- Historical tenant sales

- Financing summary

- Description of physical & environmental issues

- Cash Flow Model

Targeted Characteristics

ACQUISITIONS

President, CIO & Managing Principal

jbisenius@amcap.com